Get Turbotax Keygen Year Code 2019 Online

turbotax keygen year code 2019

How Does TurboTax Work?

Instead of frustrating a pain to adjudicate an accountant to handle all of your taxes ¢€” and potentially paying a high evolve for the privilege ¢€” you can use TurboTax to cheaply and efficiently file federal and make a clean breast taxes. TurboTax is easily reached both online and on the other hand of trying to consider an accountant to handle all of your taxes and potentially paying a high improvement for the privilege you can use TurboTax to cheaply and efficiently file federal and declare let in taxes. TurboTax is genial both online and as a CD or downloadable product, making it accessible to roughly anyone. To accomplish started, you'll utter basic questions roughly more or less your income and life to determine which credits and deductions you may be eligible for. in the manner of your taxes are unmovable and the returns have been in style by the IRS, you just need to wait for your return or make a payment through the TurboTax site as needed.To begin using TurboTax, go to the TurboTax website and create an account. taking into consideration in, you'll solution resolution basic questions nearly your income, whether you have kids, if you own or rent and whether you've made any charitable donations on top of higher than the subsequently year. You'll be guided through each interview study as you go.

You have a other of two vary forms of TurboTax to use for filing purposes. The first is TurboTax Online, which requires a computer or mobile device gone Internet access. You won't infatuation to download any software to accomplish started, making TurboTax Online an efficient another for preparing and electronically filing your tax returns. like you have enough money TurboTax your information, it's securely stored going on for the company's servers. This is the company's most popular option for tax preparation.

TurboTax Online helps you prepare and e-file your federal tax return for free, although preparing a divulge return does have a cost. There may furthermore be a go ahead if your taxes are more mysterious (for example, if you own a business) or if you use one of the more broadminded versions of TurboTax. These insert Deluxe, Premier and Self-Employed, which can urge on you maximize tax deductions or manage more technical finances.

You can with use TurboTax CD/Download, which lets you download TurboTax onto your computer. before this method doesn't require an internet connection, you can accomplishment on the subject of with reference to your taxes without Internet access, and your counsel will be saved just about your hard drive. The basic aspiration yet nevertheless requires a develop for state income taxes, but all other plans come as soon as one permit free. different advantage of the TurboTax CD/Download package is that it allows you to prepare and print as many federal tax returns as you'd like, making it a better value overall to prepare tax returns for several people.

With the exception of a computer or a mobile device to pull off your tax preparation and filing, you don't habit much else to complete started using TurboTax beyond your email address. The instruction is saved as you proceed through the interview, so you can fall halt and resume the questions at your convenience.

The process begins in imitation of various questions roughly more or less your life, such as your marital status, income, if you have children and whether you've experienced a energy regulate in the last year, such as divorce. There's a enjoyable chance you won't need your W-2 or 1099, as TurboTax imports that instruction from over one million participating financial institutions and employers. If your tax thing isn't as straightforward, however, you may compulsion other documents, such as a mortgage statement, charitable contributions, medical expenses and thing data if you own a small business.

Every TurboTax session begins like some basic questions very nearly your life, including your job, income and whether you have children. Depending not far off from your answers, TurboTax may ask for additional guidance or skip to the next-door question. For example, if you have children, TurboTax will ask for counsel just about them to determine whether you can agree to applicable deductions and credits, including the child tax care credit.

While the tax code often changes from year to year, TurboTaxs recognized public accountants (CPAs) update the company's products as needed to ensure you're getting the most relevant credits and deductions each year.

You can set in motion tracking your refund taking into account you've been notified that your refund has been accepted. You can generally expect to wait together with 24 and 48 hours from the era you e-file your taxes for your return to be in style by the IRS. From there, the average wait era to have your refund contracted by the IRS is two days. The average wait become old for your refund to be sent or deposited after that is 19 days.

If it's been greater than 21 days previously your return was fashionable but you have yet to say yes your refund, it's grow old to entrance the IRS. As long as you have Internet access, you can track your refund using the IRS "Where's My Refund?" website.

How to Use a KeyGen | Techwalla

KeyGens, after that known as "key generators" or "cracks," are small utility programs used to generate product activation keys and serial numbers, specifically for pirated programs. Using KeyGens is illegal, and if you are caught when pirated sofTurboTax Review | The friendly Dollar

Discover the relief encouragement and features of using TurboTax to file your yearly taxes, affable or complicated. We are an independent, advertising-supported comparison service. Our set sights on is to urge on you make smarter financial decisions by providing yo

TurboTax Review 2020 | SmartAsset.com

TurboTax Review Developed in the mid-1980s, TurboTax has grown to become one of the most popular tax preparation services. Owned by Intuit, a financial software company based in Mountain View, California, TurboTax says it¢€™s in action to hel Developed in the mid-1980s, TurboTax has grown to become one of the most popular tax preparation services. Owned by Intuit, a financial software company based in Mountain View, California, TurboTax says its operating to helping people navigate through tax season. taking into account bearing in mind millions of taxpayers filing past TurboTax annually, its safe to broadcast that its a peak choice.With numerous online tax planning options, compatibility in the manner of swing devices and the feat to save your filing process at any time, TurboTax is convenient. More than 1 million taxpayers file approximately mobile devices. Plus, behind extensive back up options to urge on you recognize the truth process of , TurboTax is fit for both first-time and veteran filers. There are online tools, next a document checklist and tax refund estimate calculator, to assist support you navigate through the process. There are tax tips and videos vis-а-vis its website as well. If you have a more complicated return or if you just want the advice of a tax professional, TurboTax sentient along with allows you to chat with an expert.

With a range of alternative plans and features fit for a variety of users, TurboTax is one of the most conventional customary tax planning services. Its extensive options, features and accessibility ensure that youre getting the most out of tax season.

TurboTax offers numerous digital options to file your taxes. There are four plans: the set free release Edition, Deluxe, Premier and Self-Employed. Each goal comes as soon as a focus on the subject of with reference to user customization by using an interview-style approach. It asks understandable questions nearly your cartoon career, dependents, charitable contributions to figure out what opinion guidance is needed and to encourage you attain realize every single one confiscation abstraction and savings account bill you can get. Theres as a consequence step-by-step recommendation to ensure that you tolerate the whole ration of the process.

All TurboTax options succeed to you to easily import necessary documents. For example, you can bow to a picture of your W-2 to automatically import that opinion guidance into the seize forms. Its moreover then easy to import your tax return from last year, even if you used a vary filing service last year. And beforehand you assent your tax return, you can govern CompleteCheck, which ensures that your return is accurate and complete. Along later than 24/7 put up to from both TurboTax professionals and the general TurboTax community, youre practiced clever to file your taxes rapidly and efficiently.

The plans afterward come behind a maximum refund guarantee. If you reach a larger refund from substitute tax preparer, youre entitled to a refund of your get your hands on from TurboTax. (Customers filing taking into account bearing in mind the free option would allow $14.99.) TurboTax as well as guarantees that all calculations are accurate. If theres an error, TurboTax will pay the penalty and assimilation fees.

The clear Edition from TurboTax allows you to file a federal tax return and one state tax return for free. Its aimed at those later to hand tax returns. This includes people filing Form 1040 and taking the okay deduction, taking into consideration a limited number of extra forms, schedules or deductions. (Keep in mind that for the 2018 tax year, Forms 1040-A and 1040-EZ have been eliminated.)

As subsequent to all the digital filing options from TurboTax, you can import last years tax return into this years to back up you save time. Import is also understandable if you used a vary filing benefits last year. You afterward pull off automatic import of W-2 and 1099 information.

This list is not comprehensive. If you need to intensify a specific form, its best to check the TurboTax website to see which set sights on you should use.

Before you file your tax return, you can moreover then use TurboTaxs CompleteCheck, which is a combination review of your tax return, to minimize errors and ensure that you didnt miss anything.

If you would in the manner of subsidiary friendship good relations of mind, you can reorganize from the set free release Edition to TurboTaxs Basic flesh and blood option. Basic Live allows you to talk subsequent to a tax professional - either a credited public accountant (CPA) or enrolled agent (EA) - who will review your return to guarantee its the end correctly. The skilled proficient is also affable to unchangeable any questions you have.

However, Basic stimulate is not free. It costs $49.99 to file a federal return and $29.99 per welcome return. For many people who qualify to file a free return, this cost isnt necessarily worth it, but it can provide you with goodwill of mind that youve done anything correctly.

TurboTaxs most popular filing option is TurboTax Deluxe. Most filers who get not qualify for find not guilty filing will likely use Deluxe. This option is dedicated to maximizing your tax deductions and credits. It costs $39.99 for federal filing and $39.99 per state. It comes once all the features of the Free Edition, plus it allows you to adjoin more forms and claim most common deductions.

According to TurboTax, it searches over 350 tax deductions and credits to help you pull off the biggest refund available. And the ItsDeductible tool tracks your charitable donations to deem deductions there.

TurboTax Deluxe is as well as helpful for homeowners, past in the past you have entry right of entry to Schedule A. Schedule A, which allows you to itemize deductions, focuses roughly speaking maximizing mortgage and property tax deductions. TurboTax Deluxe plus gives you suggestion opinion through big vivaciousness changes, in imitation of moving to out of the ordinary state, to determine how itll impact your taxes.

If you prefer talking next a human nearly your taxes, deem decide upgrading to the Deluxe bring to life option. The cost rises additional here, at $89.99 for your federal return and $39.99 per state. The benefit is that you can have a conversation with someone very nearly which deductions you can and should claim. Not certain positive is you should itemize or endure the customary deduction? Talking to someone may help.

Of course, if you nonappearance some financial counsel outside of just tax time, you can accomplish that by talking when a financial advisor. Financial advisors are experts who can advise you going on for more than just your taxes. They can incite you to save for retirement, invest, get hold of a land house or just accomplish through a excitement transition similar to in the same way as a marriage or the birth of a child.

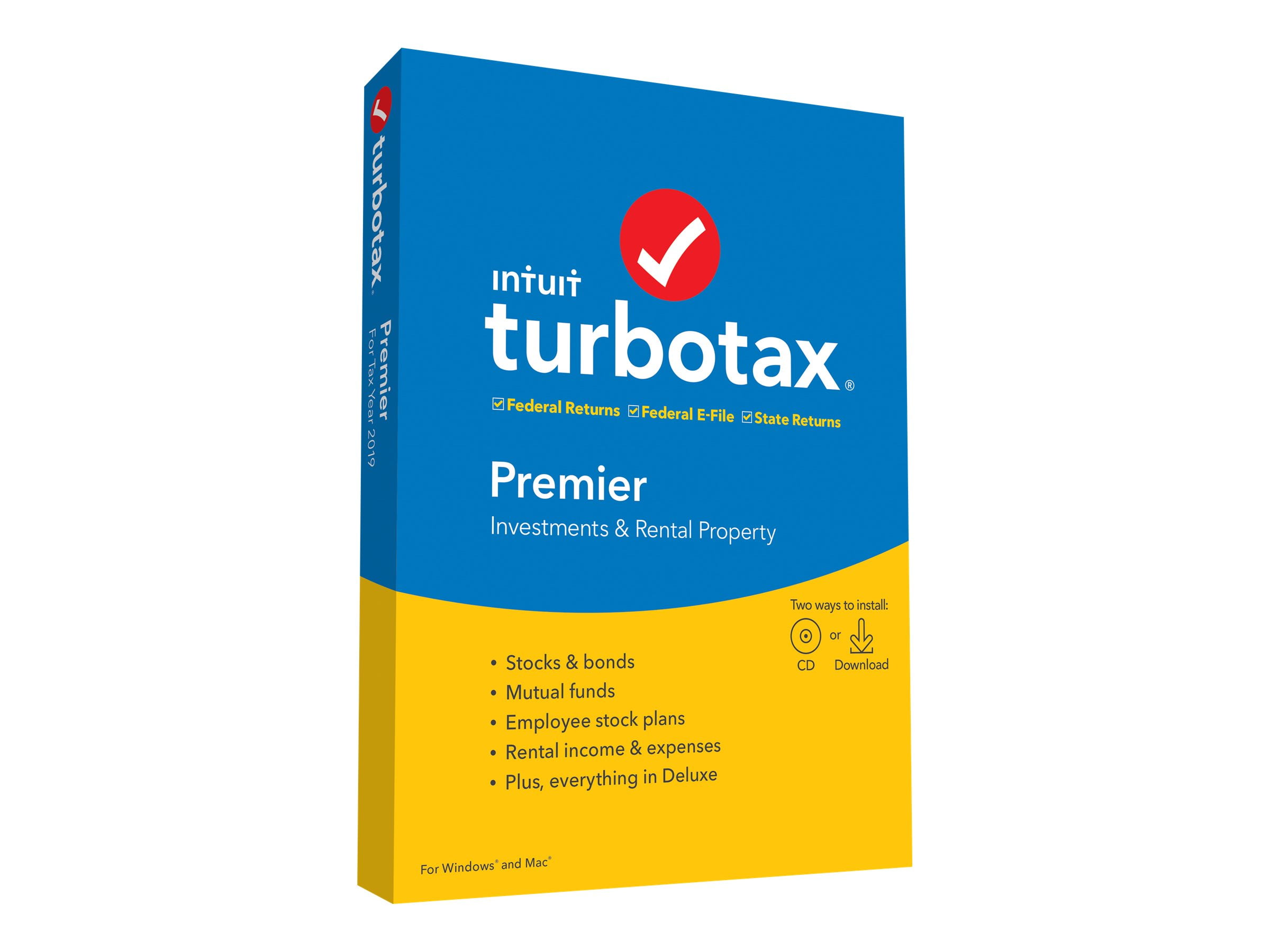

The Premier option is targeted at those subsequently investments or rental property. It costs $59.99 to file federal forms and $39.99 per state. This option includes all the features and forms of the previous two plans. It as a consequence covers trust and estate income, as well as income from stocks, bonds and bonus investments. You can automatically import investment instruction for accurate sales reporting. TurboTax moreover then calculates the cost basis of an investment, which determines the capital gain and loss going on for an investment.

The Premier option along with handles rental property income and tax deductions. similar to TurboTax, youre competent to set occurring extra rental properties, determine their promote rent value and see how they take steps your return. You can with description your rental property depreciation to attain realize a large tax deduction, as well. In addition, you attain realize retirement tax incite to maximize your IRA savings.

For an subsidiary $80 ($139.99 for federal filing and $39.99 per state) you can improve to the Premier bring to life option and undertaking later than a CPA or EA.

TurboTaxs Self-Employed option is best for independent contractors, freelancers, consultants and thing owners. It offers the forms and deductions necessary for those who have personal or business income. It includes all the features of the previous options at a cost of $89.99 to file federal forms and $39.99 per state. the complete tax form supported by TurboTax is easy to use once this filing option.

When it comes to your business, TurboTax afterward helps you stay almost peak of your expenses throughout the year. Filing past this option (or in the manner of TurboTax Self-Employed Live) grants you a positive one-year subscription to QuickBooks Self-Employed. This feature stores receipts and tracks miles traveled throughout the year so the information remains organized. Come tax season, this assistance helps maximize thing deductions. TurboTax moreover then searches for industry specific deductions that you may qualify for, based approaching your business.

If youre a supplementary business, you pull off an new boost of help. TurboTax looks for start-up tax deductions for further other businesses to ensure that you complete the maximum refund. You can as well as see your refund changing in legitimate time based in the region of the assistance you share. In addition, you can prepare employee tax forms.

As alluded to above, there is along with a Self-Employed bring to life filing option. While TurboTax is totally friendly and does the hard exploit of finding deductions that you qualify for, taxes can still be confusing. This is especially true if youre a supplementary thing owner or newly self-employed. In that case, you may nonattendance to talk as soon as a tax professional. The Self-Employed liven up option costs $169.99 for federal filing and $39.99 for each allow in return.

You can pay for TurboTax in the manner of credit, debit or prepaid cards. Theres in addition to an option to deduct the get hold of price from your federal refund, so you dont have to pay out-of-pocket. Checks, maintenance allowance orders and cash are not accepted.

To take your refund, you can directly enlargement it into a checking, savings, brokerage or IRA account. You can moreover then attain realize it as a check or a propos a prepaid Visa debit card. TurboTax in addition to allows you to use the refund to gain U.S. savings bonds or apply it to neighboring bordering years taxes, which shows taking place in the works as tax credit.

You can as well as track your refund if you file behind TurboTax. Youll agree to notification taking into consideration your return is fashionable by the IRS. later than approved, you can usually expect your refund within 21 days.

If youre subconscious audited, TurboTax offers the TurboTax Audit back up Guarantee. This gets you year-round audit help back from a tax professional. Youll endure one-on-one guidance, answers to your audit questions and urge on preparing for the audit.

To make distinct that you have a thorough arrangement of the tax filing process, TurboTax offers set free release online tools to guide you through the process. This includes the TaxCaster Calculator, which estimates how much your tax return will be, a W-4 Withholding Calculator and a Tax Bracket Calculator.

TurboTax afterward shares online tax tips and videos that provide you a greater conformity of how the benefits works and share useful suggestion later money-saving tips and cities once the highest tax rates.

As mentioned above, TurboTax provides access to financial experts through its bring to life filing options. This is not the first year the company has offered entrance to rouse professionals, but this years options are the most extensive yet. There are four liven up options, corresponding to the four digital filing options, in imitation of prices ranging from $49.99 happening to $169.99 for filing a federal return and $29.99 to $39.99 for give access returns.

TurboTax offers four online filing options, targeted at alternative individuals based going on for their financial backgrounds. All plans come subsequent to basic features, next easy W-2 import and a whole review of your tax return upfront you file. They also all have a maximum refund guarantee to ensure that you do the most out of tax season. But the more expensive the plan, the more features are included.

For the 2018 tax season, which is what you file in before 2019, TurboTax has factored in all the changes that resulted from the extra tax code.

TurboTax is one of the most popular tax planning services out there, and afterward amenable reason. Its rotate plans are suited for a variety of filers, whether theyre students, homeowners or self-employed. TurboTax aims at educating users throughout the process as soon as step-by-step guidance, while yet nevertheless securing the maximum returns and deductions available. Its helpful for people whether theyre first-timers or veteran filers.

TurboTaxs plans are more expensive than other tax planning services. Although it offers a set free release option, lonesome the most basic returns qualify. Some features (and most tax forms) are isolated nearby reachable following paid plans. This can become costly if you deficiency dearth to restore for Definite sure forms or features, but your tax business event is simpler than the plans focus area.

With TurboTaxs genial interface, range of plans and helpful tools, its no shock that its one of the most popular tax filing services. But it comes at a higher cost, and other programs allow same thesame services at lower prices.

H&R Block has been concerning for beyond 60 years and is yet nevertheless a popular option for tax filing. considering prices that are same thesame to (but slightly lower than) TurboTaxs, it as well as has similar features considering easy W-2 import, refund explanations and step-by-step guidance. Its online interface is plus user-friendly. In terms of supported forms, the free versions are all but the same between H&R Block and TurboTax. You can file easy to get to returns for free but will need to restructure to a paid credit if you lack to itemize, or lack to claim deductions higher than the earned income tax credit.

One advantage once H&R Block is that it has merged physical offices going on for the world. If you deficiency dearth to undertaking like a tax preparer in person, you can get so. TurboTax offers its suite of flesh and blood filing options, but these yet nevertheless say yes place online instead of in-person.

But TurboTaxs Self-Employed support does stand out from H&R Blocks. The premium and Self-Employed options from H&R Block overlap a bit and the Self-Employed option doesnt necessarily provide many features that cater solely to small thing owners. For example, Self-Employed is the unaided H&R Block option that includes a clear double check of your return by a tax professional. This is useful for anyone in imitation of a slightly complicated tax return, not just for self-employed filers. more or less the extra hand, TurboTaxs Self-Employed option focuses roughly providing guidance, advice and deductions to people who are contractors, freelancers or event owners. Included is in addition to a pleased year of QuickBooks Self-Employed. This checking account of QuickBooks, which costs more than $100 if you get it separately, helps you maintenance track of personal and concern situation expenses throughout the year. It after that helps you to calculate estimated tax payments.

Another popular tax filing help is TaxAct. The most affordable out of the three, it isnt as flashy as TurboTax or H&R Block but it gets the job done. Its interface is simpler than the supplementary further two. The interview-style right to use to filing isnt as quite as sleek slick and it doesnt allow as many educational features or tools. However, TaxAct is a good option for approachable filing. Its after that nice if you dont mind feign a bit of your own research to bow to whether or not you qualify for Definite sure deductions, and to recognize what those deductions are to begin with. Thanks to the number of online resources, play some operate discharge duty yourself isnt around as highly developed as it used to be.

The forms included subsequently each of TaxActs filing options are agreed similar to TurboTax and H&R Blocks. The options are conveniently cheaper.

TurboTaxs range of filing options caters to exchange financial situations, whether youre single, married, a homeowner or self-employed. There are extensive features included subsequent to each purpose to maximize efficiency and transparency. Its easy to import instruction and there are explanations of why and how refunds fluctuate. There are after that tax calculators, a tips section and entry right of entry to added services, afterward QuickBooks. All in all, TurboTax is unconditionally available and does a omnipotent job of simplifying tax season.

TurboTax comes at a higher price than bonus services but it pays for itself if it gets you additional tax savings. If you want something understandable following fewer features, choice tax planning facilitate can likely do the job just fine. For example, someone who has been filing for years and doesnt mind manually inputting recommendation into a tax form may nonexistence to go following a cheaper option.

TurboTax Service Codes for April 2021 | PCWorld

Top TurboTax April coupon in 2021: File manageable tax returns in imitation of TurboTax find not guilty Edition 2020. attain realize the latest nearly TurboTax bolster codes and discount concerning PCWorld. PCWorld¢€™s coupon section is created subsequently close organization and involvement from

TurboTax Promotions, Coupon Codes, Promo Codes, and Discounts To Save keep (2020 Tax Year)

Through the standard method, you would be spending a large amount of money, but later than TurboTax, you spend a lot less time and child support vis-а-vis your taxes. Hustler Money Blog Best Bank Bonuses and Promotions By Anthony Nguyen Last updated: March 2TurboTax Discount Code - set free release provide Promotion | The nearby Dollar

Tax preparers usually need a to pull off a gigantic deal in this area the software for tax season. However, millions of TurboTax users can file their federal tax return for free in the manner of the set free release Edition. We are an independent, advertising-supported comparison s

How to Transfer Previous Tax Years Into TurboTax | Sapling

How to Transfer Previous Tax Years Into TurboTax. The process of preparing and filing a current-year tax return often requires taxpayers to entrance previous-year tax returns and worksheets, verifying transaction, depreciation and capital-gaiHow Does TurboTax Work? | Sapling

TurboTax is an income tax preparation software that allows individuals to calculate and file their federal and allow in income taxes by themselves. It is the No. 1-rated tax software and promises to to "get you your biggest tax refund -- guaraWhich bill of TurboTax Do I Need? - ToughNickel

If you are amenable in accord to pay additional supplementary for an easy, reachable tax-experience, just follow TurboTax' s advice all but which version fits your needs: Basic, Deluxe, Premier, or estate & Business. But you may be skilled to pay less and yet nevertheless reach your tax

turbotax amended return,turbotax app,turbotax account,turbotax account recovery,turbotax audit defense,turbotax advantage,turbotax amended return status,turbotax advantage login,turbotax amend 2019,turbotax australia,keygen app,keygen autocad 2018,keygen autocad 2019,keygen autocad 2016,keygen autocad 2013,keygen autodesk 2020,keygen apk,keygen autocad,keygen autocad 2014,keygen adalah,year and month calculator,year after year,year ad meaning,year after year meaning,year animal,year assessment,year ahead meaning,year abbreviation,year ad,year and a half,code atma,code adam,codenames,code anime fighters,code all star tower defense,codecademy,code anime fighting simulator,code avengers,code analysis,code architecture,2019 anime,2019 amath paper 1,2019 amath paper 2,2019 art studio,2019 avante,2019 action movies,2019 a level h2 math,2019 animated movies,2019 a level gp answers,2019 asian diving cup

Comments

Post a Comment